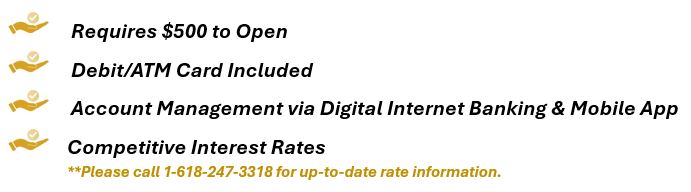

We offer a variety of different options for Checking, Savings, CDs, and other account services. The following information provides details for available account services and applicable disclosure information for Midwest National Bank's Consumer Money Market account product.

Consumer Money Market

The Consumer Money Market account is an excellent choice for account holders who desire to primarily earn interest with their money. A money market account should not be compared to a traditional checking account which might be capable of earning interest due to the minimum daily balance requirement of $2501 in order to earn interest.

The Consumer Money Market account is a perfect fit for customers who are planning for short-term savings and liquidity.

Ideal for customers with short-term financial goals, rainy day financial planning, and investments for specific larger item purchases like automobiles, boats, recreational vehicles, and many other forms of purchases.

A Consumer Money Market account which falls under $1,000 daily balance is subject to a $10 monthly service fee for all statement periods in which the account balance was under $1,000. Interest is automatically credited to this account on a quarterly basis, interest begins to accrue on the business day you deposit non-cash items such as a check for example. The interest rate can be changed at the bank’s discretion on a daily basis to reflect fluctuations with associated interest rates.